P3 Accounting Llc Can Be Fun For Anyone

Wiki Article

A Biased View of P3 Accounting Llc

Table of ContentsRumored Buzz on P3 Accounting LlcNot known Facts About P3 Accounting LlcThe Main Principles Of P3 Accounting Llc Not known Facts About P3 Accounting LlcUnknown Facts About P3 Accounting Llc

We have a team of over 200 experts with diversified histories. We concentrate on providing accountancy options to specialist service organizations. We offer even more than 2 dozen specialized industry technique groups with deep understanding and broad experience in these fields: Literary Solutions; Agencies; Innovation, Web, Media and Enjoyment; Building And Construction; Production, Selling and Circulation; Maritime, and Cost Partition Teams.By Kimberlee Leonard Updated March 04, 2019 Accounting companies use a myriad of solutions that aid company owner stay monetarily arranged, tax compliant and that help prepare for organization growth. Entrepreneur shouldn't check out an accounting firm merely as an outsourcing cost for bookkeeping however as an integral service partner.

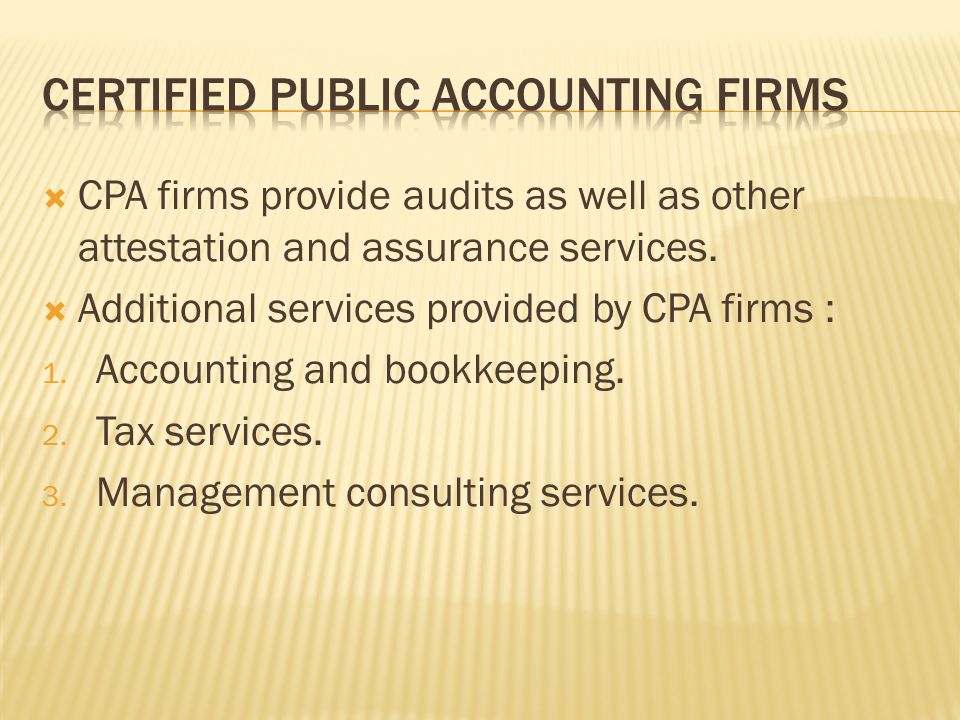

While some accounting companies concentrate on niche solutions such as tax obligation approach, many will offer accounting and pay-roll services, tax obligation prep work and organization assessment services. There is a lot more to tire preparation and preparation than completing tax obligation returns, although accounting firms prepare both state and federal business income tax return. Accountancy companies additionally prepare year-end service records, such as internal revenue service owner K-1, employee W-2 and 1099-Misc forms.

Additionally, entrepreneur need to develop service entities that create most positive tax scenarios. Audit firms help identify the most effective options and that aid in the creation of entities that make the most effective tax feeling for the business. Some estate preparation needs are unique to numerous entrepreneur, and an accountancy company aids determine these.

The 7-Minute Rule for P3 Accounting Llc

Firms will work with estate planning lawyers, financial planners and insurance representatives to apply long-lasting strategies for service transfers and to alleviate inheritance tax. Lots of local business owner are excellent at providing the services or product that is the foundation of the service. However entrepreneur aren't constantly specialists at the monetary aspects of running a service.Duplicates of organization savings account can be sent out to bookkeeping companies that work with accountants to maintain precise cash money circulation documents. Accountancy firms also create revenue and loss declarations that break down vital locations of expenses and revenue streams (https://fliphtml5.com/homepage/jliur). Bookkeeping companies also might aid with accounts receivable and take care of outgoing cash that consist of supplier settlements and payroll handling

Audit firms are integral when an organization requires to create assessment reports or to get audits that financing firms require. When a service seeks a financing or financing from a private financier, this deal requires to be properly and precisely valued. It is likewise needed for possible mergings or purchases.

Some accountancy firms likewise aid brand-new services with pro forma economic declarations and forecasts. OKC tax credits. Pro forma financials are made use of for preliminary funding or for business development. Audit firms utilize industry information, together with existing company financial background, to determine the information

The Best Guide To P3 Accounting Llc

The Big 4 likewise use electronic improvement speaking with to serve the needs of companies in the electronic age. The "Big 4" refers to the 4 biggest accounting companies in the U.S.The largest accountancy companies utilized to comprise the "Big Eight" but mergers and closures have reduced the variety of top rate firms.

Arthur Youthful integrated with Ernst & Whinney while Deloitte Haskin & Sells combined with Touche Ross to lower the group matter to six. Cost Waterhouse and Coopers & Lybrand combined their practices, making the overall 5.

Rumored Buzz on P3 Accounting Llc

The vast bulk of Ton of money 500 companies have their economic declarations audited by among the Big 4. Big Four customers include such company giants as Berkshire Hathaway, Ford Electric Motor Co., Apple, Exxon Mobil, and Amazon. According to a 2018 record by the CFA Institute, 30% of the S&P 500 were examined by Pw, C, 31% by EY, 20% by Deloitte, and 19% by KPMG.With 360-degree views of companies and sectors, the Big 4 are authorities in the organization. They have extensive recruiting and training programs for fresh graduates and supply prized channels for tax and consulting experts to and from various industrial sectors. Each Big Four firm is a make-up of individual specialist solutions networks as opposed to a single company.

Getting My P3 Accounting Llc To Work

Despite overall company growthFirm Deloitte's 2021 United States revenue declined from Decreased. 1 billion, the second highest amount for Big Four companies but just up 2% (in its local money) from the year prior.

Worldwide, Pw, C operates in 152 nations and its worldwide workforce numbers 328,000 people. Throughout financial year 2021, Ernst & Young reported approximately $40 billion of company-wide income, a rise of 7. 3% check my site from the year prior. EY has taped 7. 3% substance yearly development over the past seven years.

Report this wiki page